The Idiot Resident’s Guide to Personal Finance

To be clear: you are not an idiot. You might feel like one, but it’s only because…

To be clear: you are not an idiot. You might feel like one, but it’s only because you’ve spent the last 8+ years working toward one goal, and one goal only. And now that you’re finally on the “doctor” trajectory, you feel lost. So if you’re like me — and you feel like you’re behind on life in terms of personal finance — read on.

As my financially-literate best friend once told me: the best time to start was yesterday. The second best time is now.

I want to share some of the things I’ve learned, some of the resources I’ve come across, and little tidbits that might help you. This is a hodge-podge list of all my finance-related thoughts; I tried to organize them in categories, but the article is punctated by random things that I wish I’d known. Please remember that I am by no means a financial advisor, and everything I know, I learned from reading books, watching videos, following Instagram accounts, and pestering my reluctant friends.

Also, I’d like to preface this by two important things regarding personal finance:

- My parents taught me really good money habits growing up. My family wasn’t rich, but we never lived paycheck to paycheck, and we were pretty frugal. Importantly, they treated credit cards like debit cards, and as I grew older, my mom taught me that sometimes quality > price, and from her, I slowly learned that cheapest wasn’t necessarily better. I am so grateful to them for instilling a solid money mindset.

- I don’t have medical school loans (more on that below).

Also, please keep in mind that a lot of my knowledge is specific for the United States, so this will be especially helpful to the people who are coming to the US for residency, or those whose noses were buried too deep in Netter’s Anatomy to learn about index funds.

Disclaimer: this post has some affiliate links, all for products or accounts I use myself. If you click the link, I do make a small percentage at no extra cost to you (and I appreciate it very very much), but you don’t have to use my link and can often find similar deals if you simply Google it.

SET YOURSELF UP FOR SUCCESS:

Before you get into all the fancy things in this blog post (points hacking, credit card bonuses, investments and more), make sure that you have the basics of financial literacy down.

Here are my tips:

- Track your spending for a few months going forward (or look back on what you’ve spent the last 3 months), and really analyze where your money goes.

- Create a budget: based on your current spending, figure out what your spending goals are and if you’re not meeting them, create a budget for yourself for the upcoming months. [I personally don’t follow a strict budget but some people find it helpful.]

- Create an emergency fund: this should be approximately 3-6 months’ worth of your expenses. Put this money aside, preferably in a HYSA (high-yield savings account, more on that later).

An interesting term to become familiar with is FIRE: “financial independent, retired early”. This is the goal for many people, and the FIRE community has tons of educational content, all for free.

BUDGETING TIPS and CUTTING COSTS:

I've used a ton of budget apps (from Mint to Monarch) and now I'm using Empower. They all work but the key is that you have to find something that works for you.

I have always been frugal. That changed a bit when I started working crazy hours in residency — I now spend a good chunk of money to live life outside of work. That being said, I still definitely save money.

- I drive an old, used car: a 2009 Honda Civic that I love, which cost me $4,200 in cash (more on that in my blog post)

- I use MINT Mobile; I started out with the $25/month plan initially and recently upgraded to their Unlimited Data plan at $30/month. This is still significantly cheaper than any other carrier I’ve found, and their service overall has been pretty good for me. Click this affiliate link to check to see if your area has good coverage!

BONUS: Get my "intro to budgeting" downloadable spreadsheet for $3!

BEST FINANCIAL LITERACY RESOURCES:

Here are some of my favorite podcasts, websites and resources (some are sprinkled into the blog post below, too). Save and bookmark these for later: your financial literacy journey starts today!

- Nerdwallet (compare credit cards, learn good financial habits, estimate cost-of-living)

- Personal Finance Club (Instagram, website): all about investing

- White Coat Investor (blog, podcast, IG): specific for doctors

- Choose FI (podcast)

- Financial Residency (podcast): specific for resident doctors, fantastic resource

- DIY Money (podcast): this is one of my all-time favorites

- How to Money (podcast)

Okay, now that we’ve gotten the basics out of the way, let’s get into the good stuff.

Intro to Personal Finance: CREDIT CARDS

I buy EVERYTHING on credit cards; my parents helped me open my first credit card when I was probably 19, and now I put everything I can on them. I didn’t use my credit card much while I was abroad for medical school, but the fact that the account was open was important. It helps because your credit score (more on that later) is comprised of many factors, and one of the biggest components of it is the AMOUNT of time that you’ve had an account open, so if you can, open a simple credit card early on

I have… eight credit cards now? Not all great decisions, but you live and you learn. There are so many reasons to use credit cards — a simple Google search will explain it — but there’s just more security than using your debit card. There’s also tons of benefits (more on that below). Why? Because credit card companies are banking on you messing up and having to pay interest.

An ENORMOUS amount of Americans are in credit card debt, because they use credit cards wrong. How do you use them right? You pay them off, IN FULL, every single month.

Autopay is/should be your best friend.

I’ve never missed a credit card payment, because I treat my cards like debit cards: I only spend money I have.*

*Okay, okay, there is one very important caveat to this. When I first moved back to the US for residency, I had a lot of expenses and essentially no income. I was lucky enough to be approved for a CapitalOne card with 0% APR for the first 18 months, which meant that I could put big expenses (moving costs, car insurance, etc.) onto that card and pay it off once I started making money as a resident. I systematically paid it off long before the 18 months was over.

Important to know: you still have to pay the monthly minimum each month for cards that are 0% APR, so set up autopay for that!

Credit Cards: The Perks

There are so many perks that come with credit cards, I couldn’t even begin to list them all. Besides the cashback/miles you earn per dollar spent (see below), here are a few examples:

- even no annual fee card: baggage delay insurance (6 hours), auto collision, lost luggage reimbursement ($3000)

- expensive cards: airport lounge access, purchase credit at different stores, much more

Credit Cards: The Bonus Game

This is the key to travel hacking: opening a new card, getting tons of miles as a bonus, and then not using that card much anymore. Here’s an example: AmericanExpress Gold Card offers 90,000 miles if you spend $6,000 within the first six months. More on this down below, but here are some key points:

- only do this if you were to spend that much money anyway: when I sign up for bonuses, I just put all my regular spending onto this card for those three to six months

- be strategic: you can pay off big life expenses a little earlier: I paid off my $360 phone bill for the year a month early so that it would fall within those six months

- open a new card when you have a LOT of expenses coming up (i.e. booking a new trip)

- make sure you can actually get the bonus (don’t just open the new card and then forget to spend)

- the MOST important part: always pay all cards off in full. Remember, that’s the ONYL way credit cards are worth it: otherwise, you’ve lost the game.

Feel free to message me on Instagram or email me to get invite links with great sign-up bonuses if you’re interested!

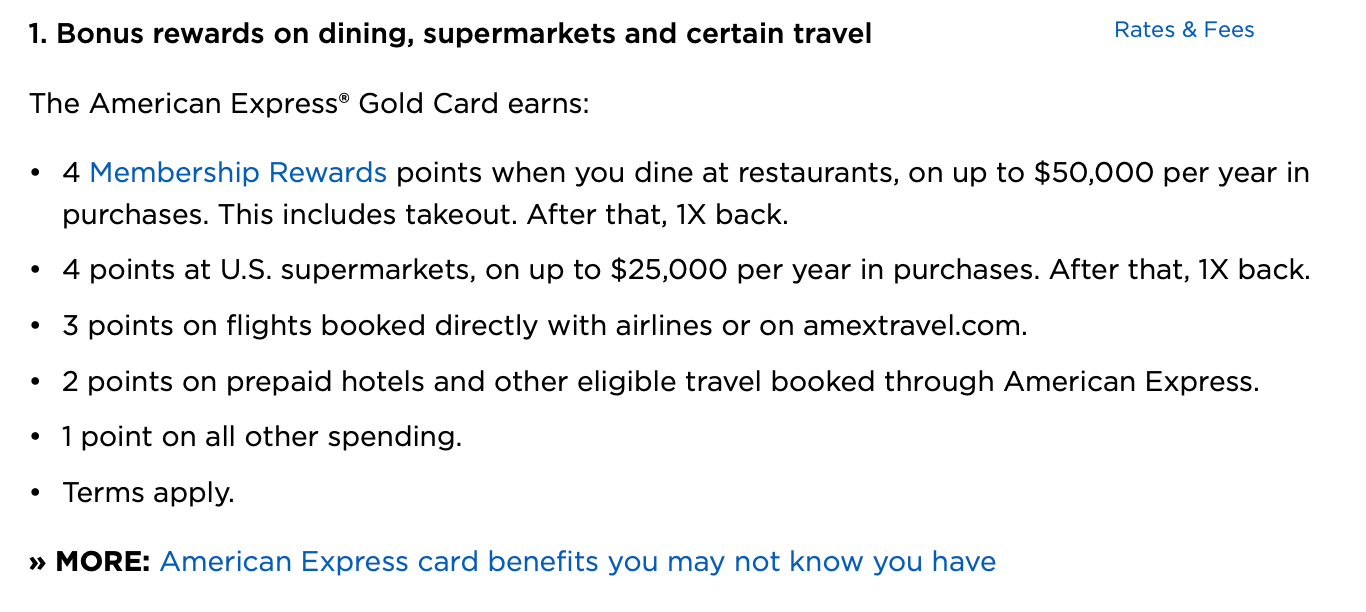

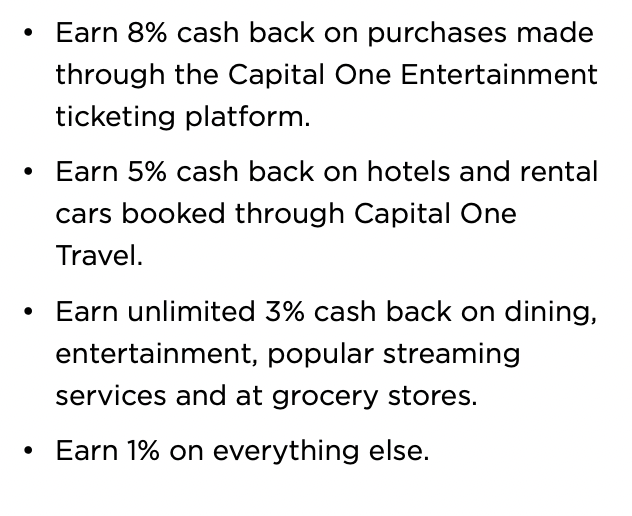

Credit Cards: Cashback vs. Miles:

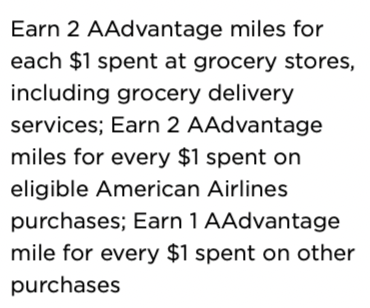

Credit cards come with different spending incentives. You can get either miles (1-5x miles per dollar spent), or money back (1-5%, usually, of “cashback” means that your statement is credited that percentage of your spending). Here is a quick comparison of the CapitalOne Savor card (left) and the AA Advantage Mile Up card (right).

Credit Cards: An Overview of My Cards

This is a list of all the credit cards I have to this date, not necessarily opened in this order. Not all of these were great decisions; not all of these make a lot of sense, now that I’m smarter. But I am “self-taught” and I made some mistakes along the way — hopefully this post will help you not make the same mistakes.

- CapitalOne Savor

- Chase Amazon Rewards

- Chase Sapphire Preferred

- Apple Card

- TJMaxx/Marshalls Card

- US Bank Cash+

- American Express Gold

- Bank of America Cash Rewards

Next Up in Personal Finance: TRAVEL HACKING

What’s that?

You might have seen people share videos: “I flew first class to Thailand and it only cost me $197 dollars!” They used points, and it’s always been a mystery to me how they’d done it. It’s really overwhelming and pretty confusing, and I’m by no means a master. Like with investments and personal finance, I certainly feel like I’m behind in the game, but better late than never.

Here are the most important points I’ve learned:

- don’t open random credit cards indiscriminately (like I did), partly because it hurts your credit score and mostly because of the 5/24 Chase rule (see below)

- don’t open cards with annual fees unless you’re really really sure it’s worth it

- don’t redeem credit card miles in their travel portal: transferrable points is how you’ll get the most bang for your buck

Personal Finance Resources for Travel Hacking:

- The Points Guy (tons and tons of blog posts to get you started; can be a little overwhelming)

- Points and Miles Doc (useful Instagram account, just launched a new online course for medical residents & travel hacking — she is so knowledgeable about this and she made an incredible resource that breaks it down for you)

Important Credit Card Takeaways:

- always pay in full

- if you pay even a cent in interest, you’ve lost the game

- utilize autopay so you never miss a payment

- do not get co-branded (store) cards unless you really really really use it

- example: I got a TJMaxx/Marshalls card — which gives 5% cashback and has no other perks — I only shop at Marshalls 10-12x a year, usually small-ish purchases (therefore, this was silly of me)

- another example: my parents renovate houses, so they have a Home Depot and a Lowe’s credit card (this makes total sense, they spend 10s of thousands of dollars there)

- read about the 5/24 Chase rule!

- in short: you will not be approved for a Chase card if you have opened 5 or more credit cards (from ANY bank) over the last 24 months; here’s a blog post explaining this in detail from TPG

BANK ACCOUNTS I HAVE:

Besides my credit card portals, I have other bank accounts. How many? Too many, but that’s kind of accidental. I have a checking account that my parents set up for me when I was young; this is connected to my parents’ account (Bank of America). I also have a checking account with the bank that gave my mortgage; it was one of the stipulations of my mortgage agreement (Valley National).

I then started to learn about personal finance and decided I wanted to open a savings account (my first ever, about 3 years into medical school!) with CapitalOne. Somehow I accidentally opened a checking AND a savings account…so now I have 3 checking accounts, whoops; this means that I have three debit cards.

And then I decided I needed a high-yield savings account and I opened one with CIT Bank at 4.5% APY.

Checking vs. savings vs. HYSA:

Let’s get into the very basics of what the difference between these accounts are. Essentially, your money exists in a bank; the amount on your account is the amount you own (unlike credit cards, where the number you see is the amount you OWE). With credit cards, you’re purchasing things on credit, meaning that you’re not spending your own money; at least, not until you pay it off at the end of the month from your checking account.

Your checking account is where your money lives. This is what you use for paying off the credit cards.

A savings account is where you can put money that you’re not planning to use: your emergency fund, money that you want to use in the next few years (for a downpayment, big trip, etc.). A traditional savings account gives you back about 0.3% returns.

An HYSA (or high-yield savings account) is similar to the traditional, but they give much better returns, 4% or sometimes even more. Certain HYSA have requirements (i.e. you have to maintain an account minimum), but any money that you’re not looking to invest should go into an HYSA.

Personal Finance 101: INVESTMENTS

Growing up, my parents never invested in the traditional sense, and so I was always really scared of investing growing up. It felt a lot like gambling, and I was taught that gambling is a slippery slope. Since then, I’ve taken it upon myself to learn what investment actually entails, and have read so much about it. I’m by no means an expert, but this is how I understand it: investing in the S&P 500, which contains 500 of the biggest companies in the world, is the way to go. Although the market can have transient dips, it eventually always goes back up, so for longterm gains (i.e. investing for retirement), you can expect a little less than 10% overall returns over time.

You can read more about the S&P 500 here to learn more about why it’s the gold standard, and how to get involved.

Watch the free video course by personalfinanceclub. You will not regret. Tons of info, squeezed into 60 minutes, created for beginners. All the information in that video series is helpful and it took me MONTHS of research to learn it on my own — I would’ve saved so much time if I had just watched it.

> Roboinvestors:

This is how I started out, when I felt like the Roth IRA / index fund / investing world was too overwhelming. I used Betterment (meh) and Acorns (better); here’s my link if you’d like to try it**. The key with roboinvestors is that the fee is higher; it’s not bad for starting out, and they do all the work for you. It’s great for beginners, but that marginally higher fee would be significant if you were putting lots of money into it. I started putting $5 a week into it during med school, and although it’s not a lot, it was something and helped me get my feet wet.

**This is an affiliate link: if you use it to open your Acorns account, you get $5 as well!

> ROTH IRA

The beauty of the Roth IRA is that your money grows tax-free. That means that you pay taxes on your annual contributions, but then when it grows over time and you withdraw in retirement: you don’t have to pay taxes on it. This is huge.

But wait, what. Let’s go back and start with the basics: what IS a Roth IRA? It’s simply an “individual retirement account.” If you know what a 401k is because you’ve heard your parents talking about it – it’s basically that, except it’s not from your employer. You open it yourself and contribute to it yourself, thus, “individual.” There is an income limit, which for us in residency is no problem since we’re usually well below that (the modified adjusted gross income in 2024 had to be under $146,000 for a single filer or under $230,000 for joint filers).

A Roth IRA is an account that is housed within a brokerage firm, such as Fidelity, Charles Schwab or Vanguard. You can think of these as trading platforms and there isn’t much difference between them.

You might have heard of funds (ETFs, index funds, mutual funds, etc.) and feel confused as to how those come into play. Watch that PFC series I shared above, but here’s a very very simplified view:

- Open an account with a brokerage firm; I use Fidelity**.

- Open a Roth IRA.

- Contribute money (connect your bank account and transfer x dollars).

- Use that money (your contribution) to purchase funds.

**Fidelity also happens to house my 403b, which is the federal version of a 401k. This is my employer-opened retirement fund, and I contribute whatever my residency program matches (so like 1%).

Which funds, you wonder?

Great question with no simple answer. The best advice I can give is to use a three-fund portfolio. Here’s another link: it’s worth reading through this blog post by PFC, one of my favorite personal finance gurus. His Instagram also has fantastic advice in the form of infographics, so give that a follow.

FINANCIAL ADVISORS:

Firstly, educating yourself about personal finance is crucial.

Secondly, not all advisors are created equal. I learned about this very recently, but a FIDUCIARY advisor is what you want. By definition, a fiduciary is legally obligated to act in your best interests. This might seem like it should be a no-brainer, but the alternative would be a non-fiduciary financial advisor, and they can legally make recommendations that may not be in your own best interest.

DISABILITY INSURANCE:

This is a big one important. You’ve spent so many years training to do this one job, and if ever you lost that ability to do that job, it would be devastating. I purchased disability insurance pretty early on in residency, but if you choose not to, that’s fine too. Just be sure that you lock in a rate BEFORE you graduate. Trust me; you could be saving 10-40% on your policy by getting started early.

Here are two useful resources to learn more about disability insurance (they do a much better job of explaining why you’d need it). They also have tons of other information for personal finance enthusiasts, so save them for later.

In short: you’re looking for a SPECIALTY-SPECIFIC policy. That means that if you get injured but can still work other jobs, you will still receive your payouts — because you can’t work in your own specialty. Although it gets a little complicated when you consider the potential “riders” aka extras that you can purchase, the sooner you start to educate yourself on disability insurance, the further ahead you will be. I’m paying approximately $90/month for mine right now.

Policies come with certain modifications or specifications, called riders. Here is a brief look at some of the common riders that you should know about when considering DI, courtesy of Pattern Life’s informational content:

– Non-Cancelable Rider: guarantees stable premiums, unaffected by insurance companies’ future rate increases.

– Guaranteed Renewable Rider: ensures policy terms remain unchanged as long as premiums are paid, providing stability

– Future Purchase Option Rider: allows future benefit increases without obtaining a new policy, offering flexibility as your needs evolve (i.e. when you graduate residency and become an attending)

– Cost of Living Rider (COLA): adjusts benefit amounts to keep pace with inflation, maintaining purchasing power

If you have questions or you just want more information, you can actually set up a free consultation with Pattern Life, which is company that works as a broker (meaning that they are trying to match you with the best policy for YOU, not trying to sell you their own policies).

Feel free to set up a call with Pattern Life, whether you’re a medical student, resident or new attending: it’s 100% free, no strings attached.*

*This is an affiliate link for the informational session with Pattern Life — however, I do not make any money off of you buying disability insurance. I really just want more people to recognize how crucial this is to set up earlier rather than later, and educate themselves.

Insurance side-note:

> Do not get tricked into purchasing whole-life insurance, unless you’re absolutely sure you need it (i.e. you have dependents relying on you, etc.). Definitely do your research before opting into whole-life.

Personal Finance & LOANS:

I do not have them. I’m the world’s luckiest medical student, and I’m (again) beyond grateful to my parents. I know a lot of medical students and residents are dealing with huge loans and are considering eligibility for PSLF, and unfortunately I do not have any good resources for that because none of it makes sense to me.

> Aside: CAR LOANS

I also don’t have these, but a lot of my co-residents do. I do talk about buying a used car in another blog post, and I although I always prefer to buy small / cheap / in cash, I know it’s not possible for everyone for the reasons outlined in my blog.

MORTGAGE:

Buying a house as a resident is not easy, and I managed it only with the help of my parents. I just have very very few things to say about this venture, because it is far outside the scope of this article (and definitely outside the scope of my wheelhouse of “expertise”):

- shop around to see which bank will give you the best mortgage; keep in mind that this can transiently affect your credit score

- know that there is such as thing as a “physician loan,” but recognize that sometimes the “first-time homeowner” loan might be better (and you can use your physician loan for a better purchase after residency)

- look for national programs that help waive fees or cover the closing costs, if you purchase in certain areas

- use Zillow’s “recently sold” feature to see what the market is like around where you’re looking to buy

I think that covers a lot of the personal finance topics that I wanted to cover for this blog post.

It’s a lot. I’m hardly an expert in MOST things investing, but I wanted to connect you to some of the resources that helped me tremendously. I hope to create a Part 2 when I have more things to share.

Any questions, or other things you would want me to cover?